Third party buyers, private equity funds, and Employee Stock Ownership Plans (ESOPs) are three good options to consider now.

While any Covid impact on recent business performance will have to be addressed, buyers are still looking for growth through acquisition, private equity funds with plenty of “dry powder” continue to aggressively seek out quality companies to buy, and transactions are getting done.

If you are like many of our clients, recent events have caused you to think even more acutely about what the future holds. If you own a business, those thoughts naturally turn to questions around the future direction, strategy, and potential exit.

Clients often ask me “Is now a good time to sell my Company?” My response is always the same, “The best time to sell your company is when you are ready.” That said, if you have been thinking about selling, the current climate, despite Covid, remains one of the best climates in recent history to maximize the value you have built through a sale.

While Covid, PPP forgiveness, shutdowns and general uncertainty have not made things any easier, buyers continue to seek growth through acquisition and transactions are getting done. That means your company is likely to be an attractive candidate to the right buyer, especially given the relative shortage of high quality, private companies available for purchase.

Private Equity Buyers with Money to Spend

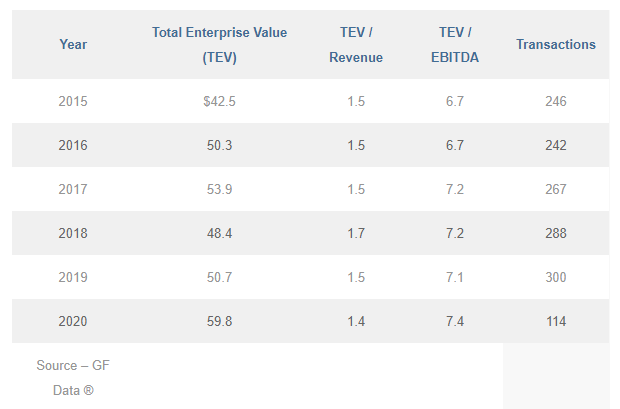

While private equity funds have been very active over the last 5 years as evidenced by the graph, the amount of “dry powder,” or committed capital seeking out acquisitions, remains at an all-time high. This means that private equity funds continue to aggressively seek out companies to buy. As their model generally involves a “buy and build” strategy, many funds are looking for add-on acquisitions to augment existing companies in their portfolios that they have purchased in the last 5 years. At the same time, most funds continue to seek out “platform” acquisitions, or foundational target companies around which they try to build through follow-on acquisitions.

Fueling the activity level, as well as valuation multiples, is the continued low interest rate lending environment, coupled with aggressive underwriting. Basically, this means that banks are loaning more money at lower rates than at any time in history, which enables PE groups to pay higher prices for the companies they acquire. When rates are low, and liquidity is present in the market, asset values generally rise, as evidenced by multiples paid by private equity (i.e. higher valuations), rising real estate prices, and record highs being achieved in the public markets.

Public Companies – Favorable to Market Conditions for Buyers Right Now

When a sale to a private equity fund is not the right fit, public companies often provide a great alternative. Here too, the market conditions are incredibly favorable to sellers at the moment. Whether public or private, companies continue to struggle to find new markets, new products, and other forms of organic growth. However, the pressure to grow is even more acute for public companies than those acquired by PE firms. At the same time, the stock prices of many public companies are either at all-time highs or at least at historically high levels. This continued need for growth, coupled with stock prices that facilitate relatively less expensive capital, enables public companies to buy private companies at historically high valuations.

ESOPs Minimize Taxes, Preserve Corporate Culture

Finally, for those owners who are concerned about preserving corporate culture, minimizing tax, and/or enabling their employees to create wealth of their own, and Employee Stock Ownership Plan, or ESOP, remains a great alternative in some cases. We are seeing ESOP transactions that rival third party sales in terms of valuation multiples and net proceeds to sellers, with less risk of transactions stalling or failing, less intrusive due diligence, and less exposure of proprietary information to a potential competitor.

While the market conditions are favorable, due diligence in the era of Covid can be especially rigorous. The ability to isolate and explain the impact of the pandemic is critical to maintaining an agreed upon valuation through closing. At the same time, the ability to show recovery, or sustainability going forward, is often the crucial factor in getting a transaction closed. Buyers will generally pay you based on the past, but only to the extent that the future outlook is positive. If you have experienced a downturn and expect to return to or exceed your pre-Covid performance, it is vital that you are able to articulate your vision for how you will do this, and provide support for your assumptions where possible.

Getting the One Right Result

Selling your company can be a daunting undertaking, and requires preparation, strategy, and execution. With over 30 years of experience in helping business owners with ownership transition, Acuity Advisors is uniquely qualified to help guide you through this process. While there are many possible outcomes to a transaction, there is generally one right result. Acuity Advisors helps you achieve it.